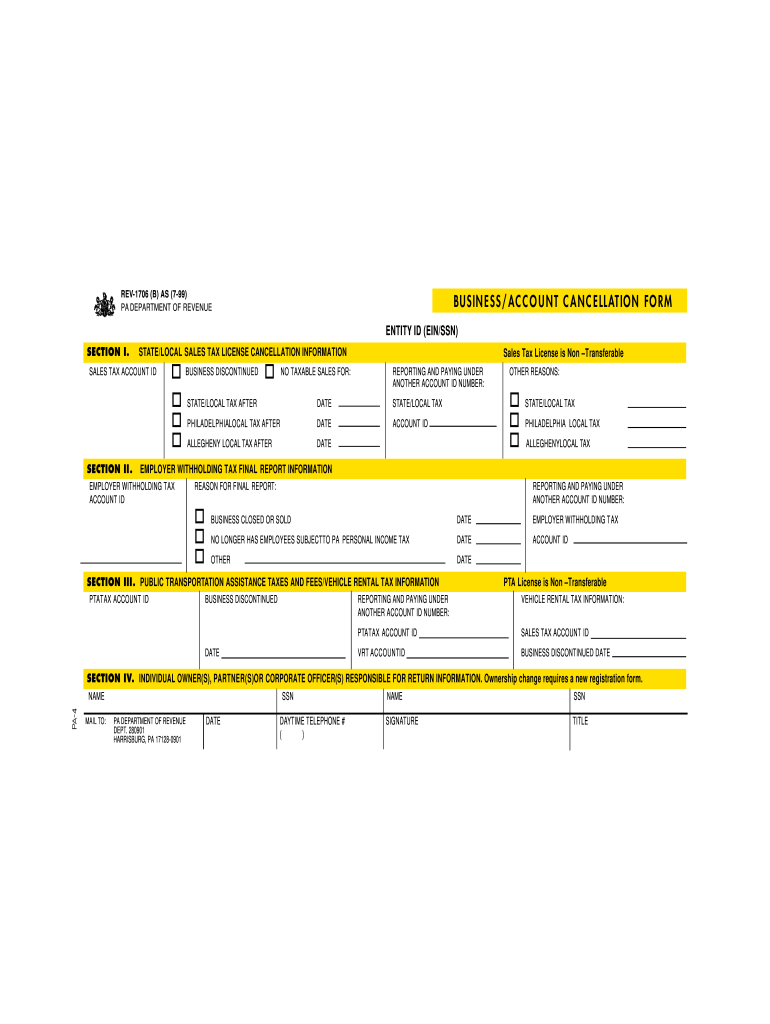

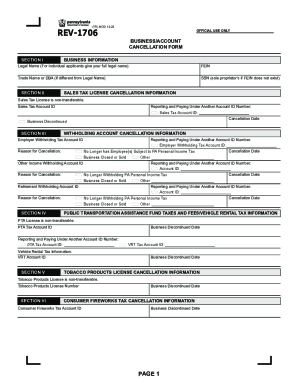

Who needs a Business/account cancellation form?

This form is used by business owners in the Pennsylvania if their business was discontinued, sold or ceased operations.

What is the purpose of the Business/account cancellation form?

This form is used to cancel the state sales tax license in case the business was discontinued, sold or ceased operations. If the business was sold and has no employees anymore, the owner should also cancel the PA personal income taxes.

What documents must accompany the Business/account cancellation form?

The Department of Revenue may ask the business owner to provide other documents together with this form if they have additional questions.

How long does it take to fill the Business/account cancellation form out?

The estimated time for completing the form is 10 minutes.

Which information should be provided in the Business/account cancellation form?

The form consists of four sections. The business owner should add the following information:

-

Legal name and trade name

-

Entity ID EIN/SSN

-

State/local sales tax license cancellation information (sales tax account ID, reasons for the sales tax cancellation)

-

Employer withholding tax cancellation information (employer withholding tax account ID, reasons for cancellation)

-

Public transportation assistance fund taxes and fees/vehicle rental tax information (PTA tax account ID, date of business discontinued, vehicle rental tax information)

-

Cigarette dealer’s license cancellation information (cigarette dealer’s license number, name, SSN)

The business owner should also sign and date the form and indicate daytime phone number and email address.

What do I do with the form after its completion?

The completed and signed form is forwarded to the Department of Revenue.